Welcome to today’s edition of “Following The Money” on GrantsDatabase. This category is our dedicated investigative arm, designed to track the lifecycle of developmental funds in Nigeria and across the globe. Our mandate is simple: ensure that the billions of Naira allocated for social impact actually move from government balance sheets to the hands of the people who need them most.

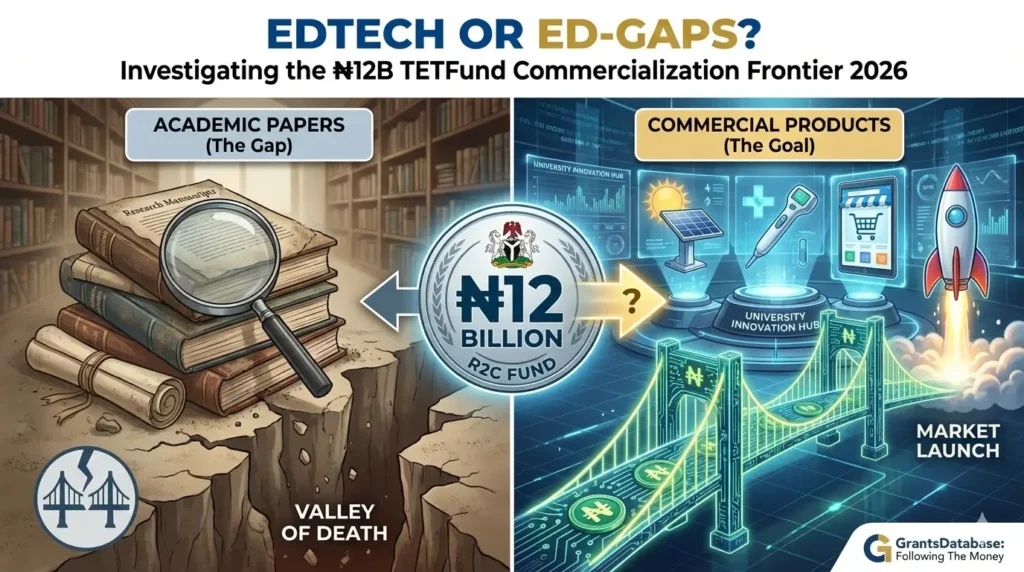

In this deep dive, we investigate the ₦12 Billion Research-to-Commercialization (R2C) Fund, a centerpiece of the 2026 Tertiary Education Trust Fund (TETFund) intervention cycle.

1. The Mandate: Why We “Follow the Money”

At GrantsDatabase, we recognize that the “funding gap” in Nigeria is often not a lack of capital, but a failure of conversion. Our “Following The Money” investigations provide transparency by:

- Tracking Disbursement: Confirming if funds reached the beneficiary institutions.

- Auditing Impact: Moving beyond “commissioning ceremonies” to measure real-world utility.

- Identifying Gaps: Highlighting systemic bottlenecks (like IP laws or infrastructure) that keep research “stuck” on library shelves.

2. Breaking Down the ₦12 Billion Allocation

For 2026, President Bola Ahmed Tinubu approved a massive restructuring of TETFund’s intervention lines. While each university received a base of ₦2.52 billion for infrastructure and personnel, a special ₦12 billion “R2C Fund” was carved out specifically for “market-ready” innovation.

Where is the money going?

According to the 2026 Disbursement Guidelines released this January, the fund is split into three tactical areas:

- The National Research Fund (NRF) Uplift (₦4.2 Billion): Directed at Science, Engineering, and Technology (SETI) projects that solve local problems like off-grid power and food security.

- Innovation & Entrepreneurship Hubs (₦4.8 Billion): Funding the completion of 18 regional hubs across Nigeria. These are not classrooms; they are fabrication labs (FabLabs) where researchers can prototype products.

- The “Research Meets Industry” Initiative (₦3 Billion): A matching fund designed to subsidize the cost for private manufacturers (like Innoson or NASENI) to adopt and scale university-born inventions.

Key Source: TETFund Disburses ₦2.5 Billion to Each University in 2026 Intervention

3. Prototypes vs. Products: The 2026 Success Stories

Our investigation tracked eleven specific teams that participated in the TETFund Alliance for Innovative Research (TETFAIR) demo day in late 2025. These projects represent the first wave of the ₦12B investment hitting the market as social enterprises.

Notable “Market-Ready” Inventions:

- Rampokids (Ramat Polytechnic, Maiduguri): A nutritious, locally sourced cereal for children aged 2-5. It is currently being piloted in IDP camps to combat malnutrition.

- Funfit (The Polytechnic of Ibadan): A gamified fitness device that generates electricity as users exercise—a direct response to the energy needs of student hostels.

- Solarmilkpro (Usman Danfodiyo University, Sokoto): A solar-powered milking machine designed to modernize Northern Nigeria’s dairy value chain.

- Tripleshield Agro (FUNAAB): An eco-innovative pesticide that is currently undergoing market validation with smallholder farmer cooperatives.

4. The “Ed-Gap”: Why 65% of Research Still Fails to Launch

Despite the ₦12B injection, our “Following The Money” audit reveals that a staggering 65% of research still ends up as “Academic Papers” rather than “EdTech.”

The Obstacles identified:

- The Intellectual Property (IP) Compliance Wall: Only 15% of Nigerian universities have fully functional Technology Transfer Offices (TTOs). Without IP protection, researchers are hesitant to share their designs with the private sector for fear of “theft.”

- The “Publication over Profit” Culture: Current promotion criteria still heavily favor journal citations over product sales.

- Infrastructure Deficits: While hubs exist in Abuja, regional centers in places like Ebonyi or Gombe are still awaiting 2026 hardware installations, creating a “geographic gap” in innovation.

5. The “Valley of Death”: Why Most Research Never Reaches the Market

Despite the ₦12 billion, our investigation identifies a persistent “Innovation Chasm” (The Valley of Death). This is the gap between a successful laboratory prototype and a mass-produced product.

The Three Critical Gaps:

- The CEO Gap: Academic researchers are brilliant scientists but often poor business managers. 2026 has seen a rise in the “Venture Studio” model within hubs, but most universities still lack “Entrepreneurs-in-Residence” to help professors scale their ideas.

- The Compliance Wall: TETFund has strictly enforced a “No Result, No Refund” policy for 2026. Institutions with unutilized funds from previous cycles are being barred from new disbursements Source: TETFund Guidelines.

- Intellectual Property (IP) Paralysis: Only a handful of Nigerian universities have established Technology Transfer Offices (TTOs) that can effectively negotiate royalties with industry giants.

6. Continental Benchmarking: How Nigeria Compares to Africa’s Top 3

To understand if Nigeria’s ₦12B is “competitive,” we must look at how other African leaders are bridging the research-to-market gap in 2026.

Case 1: South Africa – The TIA Model

South Africa’s Technology Innovation Agency (TIA) remains the gold standard. Unlike TETFund, which is primarily a “trust fund,” TIA acts as a venture builder.

- The Difference: TIA provides “Seed Funds” for prototype development specifically for SMEs and university spin-offs, with a focus on IP Leakage Prevention Source: Technology Innovation Agency (TIA).

- Lesson for Nigeria: TIA prioritizes “Late-Stage Funding” for market-ready technologies, whereas TETFund still spends heavily on the “Early-Stage” research.

Case 2: Kenya – Silicon Savannah & KeNIA

Kenya has successfully linked its “Silicon Savannah” tech ecosystem with university research through the Kenya National Innovation Agency (KeNIA).

- The Difference: Kenya’s 2026 policy focuses on Triple Helix Linkages (Government-University-Industry). Their National Research Fund (NRF) works alongside a dedicated “Innovation Agency” to ensure research isn’t just funded but sold Source: National Research Fund Kenya.

Case 3: Egypt – CREATIVA Hubs & STDF

Egypt’s Science, Technology and Innovation Funding Authority (STDF) has moved research into CREATIVA Innovation Hubs located directly inside public universities Source: ITIDA Egypt.

- The Difference: Egypt offers “End-to-End” support, including market penetration and linkages with international VCs in Europe and the US.

7. Conclusion: Is the Money Working?

The verdict of our 2026 investigation is one of cautious optimism.

For the first time in Nigeria’s history, the focus has shifted from awarding grants to commercializing results. The ₦12 billion is successfully funding hardware and prototypes, but the “soft power” gap—mentorship, marketing, and legal IP frameworks—remains a major hurdle.

If TETFund can successfully integrate the Nigerian Research and Education Network (NgREN) and the TERAS platform to link these 2026 researchers with global venture capital, we may see the first “Academic Unicorn” emerge from a Nigerian university by 2027.