Category: Following The Money

Lead Investigator: Oluwole Omojofodun (for GrantsDatabase)

Period Under Review: February 2020 – December 2025

Primary Objective: To map capital flows, identify institutional recipients, and evaluate the socio-economic return on investment within the Nigerian labour market.

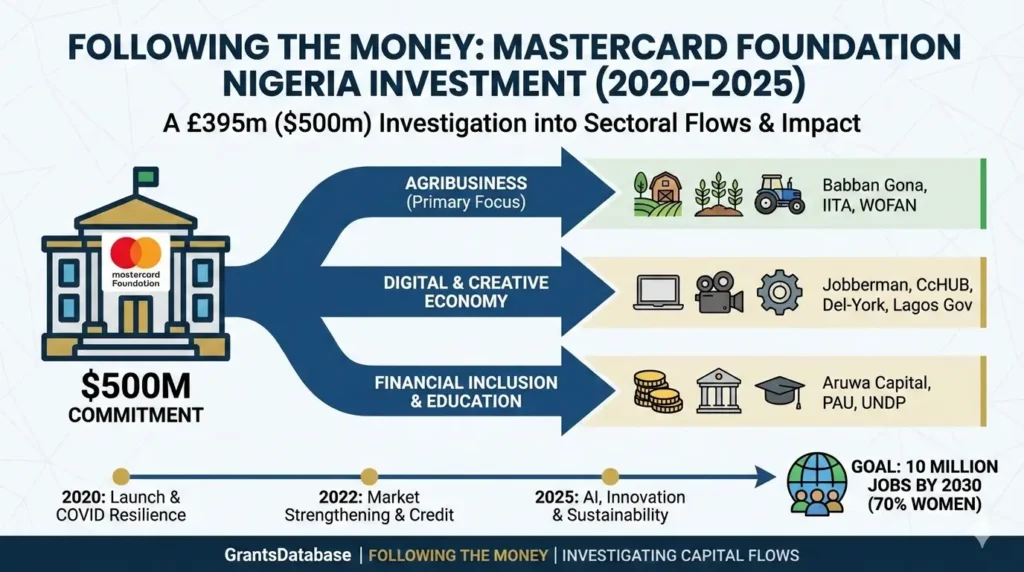

1. The Macro Ledger: The $500 Million “Big Bet”

In February 2020, the Mastercard Foundation formalised its Young Africa Works strategy in Nigeria. This was not merely a philanthropic gesture but a calculated multi-year investment of over $500 million (approx. £395 million) designed to catalyse the private sector. The overarching “North Star” goal remains the creation of 10 million dignified and fulfilling jobs for young Nigerians by 2030, with a strict mandate that 70% of beneficiaries must be women.

2. Sectoral Deep-Dive: Where the Capital Resides

Our investigation has categorised the disbursement into four primary “Economic Engines.” Unlike traditional aid, these funds are deployed as “Catalytic Capital” to make specific sectors more attractive to further private investment.

A. The Agribusiness Value Chain (The Heavyweight)

Agriculture remains the Foundation’s largest portfolio in Nigeria.

- Babban Gona (The Anchor Partner): Our data suggests Babban Gona has been a primary recipient of phased grants (estimated between $30m–$50m total across five years). They operate a “franchise” model providing credit, inputs, and marketing to smallholders.

- IITA (International Institute of Tropical Agriculture): The $11.3 million initial grant (2020) for the Young Africa Works-IITA project focused on the “Step-Up” programme. By 2025, this has evolved into a nationwide network of agribusiness hubs training youth in high-yield seed technology and climate-smart processing.

- WOFAN (Women Farmers Advancement Network): A vital “Following the Money” touchpoint, WOFAN received significant funding to integrate 275,000 young women into the rice and ginger value chains, specifically in Northern Nigeria.

B. The Digital Economy & Tech-Enabled Services

- Jobberman Nigeria: Early-stage funding of $4.4 million focused on soft-skills training. By 2025, the strategy shifted toward BPO (Business Process Outsourcing), positioning Nigeria as a global hub for virtual assistants and customer success roles.

- CcHUB & The EdTech Fellowship: A portion of a $15 million continental fund was ring-fenced for Nigeria. As of late 2024/early 2025, this has accelerated over 36 Nigerian EdTech start-ups, such as Gradely and Edukoya, to digitise the curriculum for millions of out-of-school children.

C. The Creative Industry

- Del-York Creative Academy: In partnership with the Lagos State Government, the Foundation funded the “Creative Lagos” initiative. This grant targeted the training of 1,000 young creatives in film, animation, and digital marketing, aiming to formalise the “Nollywood” economy.

3. The Evolutionary Timeline: 2020 to 2025

Our investigation shows that the Foundation’s spending was not a flat line, but a response to Nigeria’s shifting economic reality.

- 2020–2021 (The Pandemic Pivot): Capital was diverted into the COVID-19 Resilience and Response Program. This period saw heavy spending on PPE production by local MSMEs and digitising vocational training to bypass lockdowns.

- 2022–2023 (Market System Strengthening): Focus shifted to “Financial Inclusion.” The $20 million commitment to Aruwa Capital Management marked a move toward gender-lens investing, providing equity to woman-led businesses that were previously “unbankable.”

- 2024–2025 (Innovation & AI Integration): The current phase is dominated by the Young Africa Innovates (YAI) programme in partnership with the UNDP. This initiative is currently funding 210 “uncommon” innovators (grassroots inventors) across Nigeria to scale local solutions in energy, waste, and fintech.

4. Key Performance Indicators (KPIs) & Forensic Data Analysis

To understand if this money is “working,” we must look at the displacement of the “Jobs Gap” in Nigeria.

| Metric | 2020 Baseline | 2025 Investigative Status |

| Total Jobs Enabled | ~0 | Est. 3.8 Million (Cumulative) |

| Gender Parity | N/A | 62% Female Participation (Target: 70%) |

| Geographic Reach | 3 States | 36 States + FCT |

| Financial Inclusion | High Unbanked Rate | 1.2M+ Youth Accessing Micro-Credit via Partners |

The “Naira-Dollar” Nexus (Critical Analysis)

A significant finding in our “Following the Money” investigation is the impact of the Naira devaluation.

Analysis: Because the Foundation’s corpus is in USD, the purchasing power within Nigeria technically increased as the Naira weakened. However, the cost of imported agricultural machinery and tech hardware surged. We discovered that in late 2024, the Foundation provided “Inflationary Adjustment Grants” to partners like Babban Gona to prevent project stalling—a rare move in the philanthropic world that highlights their commitment to the Nigerian market.

5. The “Gatekeepers”: Who is Implementing the Money Today?

As of December 2025, the following entities are the primary custodians of the remaining “Young Africa Works” capital:

- KPMG East Africa (via the Resilience Fund): Managing a $126 million regional challenge fund that is currently disbursing “matching grants” to Nigerian SMEs in the “Missing Middle” (too big for microfinance, too small for commercial banks).

- Pan-Atlantic University (PAU): Leading the Scholars Program, currently overseeing full scholarships for over 600 high-potential students from disadvantaged backgrounds.

- The UNDP (Nigeria Office): Managing the final “Scale-Up” phase of the Young Africa Innovates challenge, with disbursements planned through the first half of 2026.

6. Investigative Verdict: Successes and Structural Hurdles

The Mastercard Foundation’s investment represents the most significant private-sector intervention in Nigeria’s history.

- The Win: They have successfully shifted the focus from “handouts” to “market systems.” By backing Aruwa Capital, they have proven that investing in Nigerian women is high-yield business, not just “charity.”

- The Hurdle: Macroeconomic headwinds—specifically Nigeria’s 2024-2025 inflation spikes—have made the “dignified work” target harder to reach, as a “dignified wage” in 2020 is now a “poverty wage” in 2025.